Section 13 - Settlements

Published 23 April 2020

Since the loan charge was announced at Budget 2016 and up to 30 June 2019, HMRC have agreed around 8,000 settlements with employers and individuals, bringing in around £2 billion.

Around 40% of the settlements are with employers who account for around 88% of the yield and around 60% of the settlements are with individuals who account for around 12% of the yield. We have previously provided settlement information to the House of Lords Economic Affairs Committee and more recently the Loan Charge All-Party Parliamentary Group. The latter was based on settlements until 31 December 2018 and, at that time, 25% of settlements were with employers, 75% with individuals, with 85% of yield from the employer settlements and 15% from individuals.

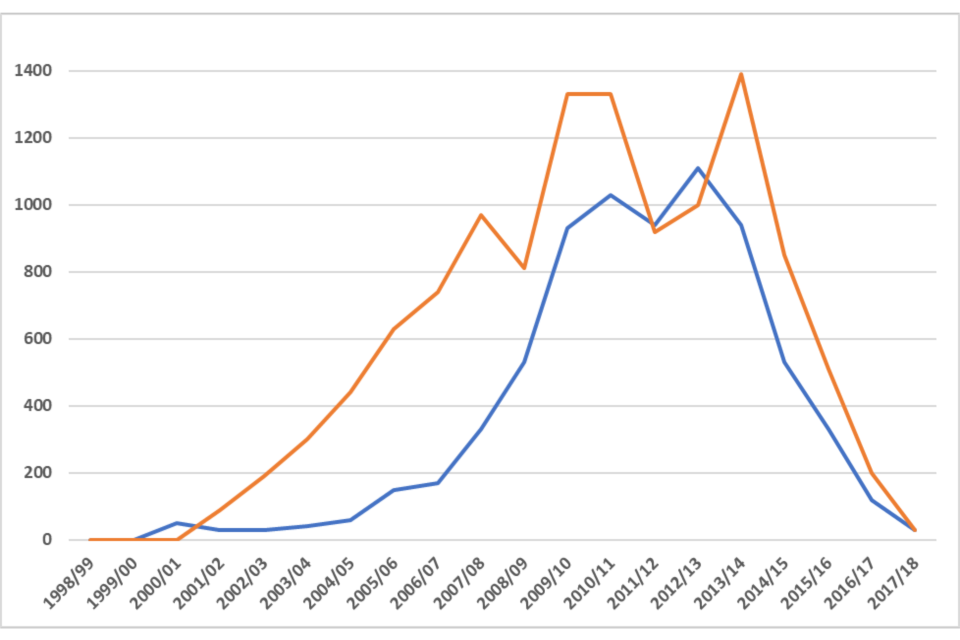

The 8,000 settlements relate to around 19,000 usages of DR schemes. A breakdown of this across years for employers and individuals is shown in Chart below:

Graph showing breakdown. Source: Analysis provided by KAI using data from Counter-Avoidance Operational database

Please find the underlying data for that chart in Table 40 below.

| Tax year | Number of settled usages by individuals | Number of settled usages by employers |

|---|---|---|

| 1998 to 1999 | <10 | <10 |

| 1999 to 2000 | <10 | <10 |

| 2000 to 2001 | <10 | 50 |

| 2001 to 2002 | 90 | 30 |

| 2002 to 2003 | 190 | 30 |

| 2003 to 2004 | 300 | 40 |

| 2004 to 2005 | 440 | 60 |

| 2005 to 2006 | 630 | 150 |

| 2006 to 2007 | 740 | 170 |

| 2007 to 2008 | 970 | 330 |

| 2008 to 2009 | 810 | 530 |

| 2009 to 2010 | 1,330 | 930 |

| 2010 to 2011 | 1,330 | 1,030 |

| 2011 to 2012 | 920 | 940 |

| 2012 to 2013 | 1,000 | 1,110 |

| 2013 to 2014 | 1,390 | 940 |

| 2014 to 2015 | 850 | 530 |

| 2015 to 2016 | 510 | 330 |

| 2016 to 2017 | 200 | 120 |

| 2017 to 2018 | 30 | 30 |

Source: Analysis provided by KAI using data from Counter-Avoidance Operational database*All numbers rounded to the nearest 10, where the underlying data shows that the actual value is less than 10, then we have supressed it to ‘<10’ to prevent disclosure of potentially sensitive information.

Table 41 below sets out when those 8,000 settlements were agreed, the value of the settlements, and the number of the 19,000 DR scheme usages they cover:

| Month | Year | Number of Settled Usages by Employers | Value of Settled Usages by Employers | Number of Settled Usages by Individuals | Value of Settled Usages by Individuals |

|---|---|---|---|---|---|

| April | 2016 | 15 | £9m | 270 | £2m |

| May | 2016 | 30 | £12m | 230 | £2m |

| June | 2016 | 40 | £4m | 215 | £2m |

| July | 2016 | 45 | £11m | 190 | £2m |

| August | 2016 | 60 | £29m | 910 | £6m |

| September | 2016 | 75 | £47m | 480 | £4m |

| October | 2016 | 90 | £35m | 100 | £1m |

| November | 2016 | 80 | £19m | 115 | £3m |

| December | 2016 | 75 | £15m | 115 | £2m |

| January | 2017 | 70 | £14m | 120 | £3m |

| February | 2017 | 35 | £8m | 105 | £9m |

| March | 2017 | 300 | £174m | 160 | £21m |

| April | 2017 | 75 | £21m | 175 | £11m |

| May | 2017 | 50 | £11m | 225 | £8m |

| June | 2017 | 70 | £21m | 165 | £7m |

| July | 2017 | 65 | £11m | 255 | £7m |

| August | 2017 | 70 | £18m | 280 | £11m |

| September | 2017 | 70 | £22m | 125 | £3m |

| October | 2017 | 80 | £7m | 205 | £5m |

| November | 2017 | 30 | £8m | 360 | £8m |

| December | 2017 | 45 | £9m | 170 | £5m |

| January | 2018 | 55 | £11m | 235 | £9m |

| February | 2018 | 70 | £35m | 240 | £4m |

| March | 2018 | 115 | £51m | 340 | £10m |

| April | 2018 | 160 | £35m | 230 | £6m |

| May | 2018 | 140 | £35m | 315 | £7m |

| June | 2018 | 135 | £43m | 210 | £5m |

| July | 2018 | 220 | £40m | 370 | £9m |

Source: Analysis provided by KAI using data from Counter-Avoidance Operational database

We have granted extended payment arrangements for those settling under the Contractor Loans Settlement Opportunity and Employee Benefit Trust Settlement Opportunity.

Under the November 2017 settlement terms, we have automatically agreed payment plans up to 7 years for someone earning £30,000 or less and 5 years for someone earning less than £50,000, without requiring detailed financial information. Individuals can have longer if they need it.

We have committed that we will not make an individual sell their main home to pay their DR debt or the loan charge.

We set up a helpline with dedicated staff trained in instalment arrangements to provide advice to individuals worried about how they might afford to pay.

The same general approach applies equally to individuals settling their underlying liabilities, and will apply once the loan charge becomes due from 31 January 2020.

We do not centrally record the length and amounts of instalment arrangements. We have analysed a sample of around 1,600 settlements by individuals under the November 2017 settlement terms. Approximately 60% did not require extended payment terms and paid the tax in one instalment, and the mean settlement amount was around £25,900.

Approximately 40% required extended payment arrangements. Of those individuals, around 60% required more than two years.

Table 42 provides more detail of the length of the arrangements and average monthly payment.

| Length of instalment arrangement | Number of cases | Average yield | Average monthly instalment | Average of months |

|---|---|---|---|---|

| Up to 24 months | 248 | £15,235 | £820 | 18 |

| 25 to 60 months | 233 | £28,947 | £499 | 46 |

| 61 to 84 months | 115 | £31,984 | £381 | 71 |

| 85 to 120 months | 53 | £58,457 | £506 | 101 |

| 121 to 240 months | 7 | £39,439 | 268 | 164 |

| Total | 656 | £26,313 | £598 | 45 |

Table 43 below shows the same information with the 2016 to 2017 income bands for each length of instalment arrangement.

| Length of instalment arrangement | Income band unknown | Income band £0 | Income band £1 - £30,000 | Income band £30,000 - £50,000 | Income band £50,000 - £100,000 | Income band £100,000 - £250,000 | Income band over £250,000 |

|---|---|---|---|---|---|---|---|

| Up to 24 months | - | - | 43% | 24% | 23% | 7% | 0% |

| 25 to 60 months | - | - | 30% | 33% | 27% | 7% | - |

| 61 to 84 months | - | - | 38% | 33% | 21% | 5% | 0% |

| 85 to 120 months | - | - | 32% | 32% | 21% | - | - |

| 121 to 240 months | - | - | - | - | 0% | 0% | 0% |

| Total | 2% | 1% | 37% | 30% | 24% | 6% | 0% |

Source: Settlement data provided by Counter Avoidance; income analysis provided by KAI sing income information on Self Assessment / PAYE returns.

- Figures have been suppressed due to case number in the underlying data falls below 5 to prevent potential disclosure of sensitive information

The average settlement yield across the sample was £26,313, which is lower than the mean of £58,000 and median of £18,000 previously set out. This is because it is only a sample of the total number of individuals who have settled.

Multiplying the average month by amount will not equal £26,313. This is because individuals are encouraged to pay what they can upfront to minimise their monthly repayments. In addition, they have often already paid an Accelerated Payment or made a payment on account so the average monthly payment is only for the remaining balance.

Since the November 2017 settlement terms were published, over 19,000 individuals and employers correctly registered and provided the relevant information to settle by 5 April 2019. By 31 August 2019, over 99% of users had received settlement calculations.

Many of these individuals and employers have reached a final contract settlement with HMRC, and some agreed the settlement amount but have not formally signed the contract agreement. The balance of around 1,000 employers and 8,500 individuals remain in the settlement process and may choose to settle.

There are different settlement processes for individuals and employers.

Due to the volume, settlements for individuals are worked in a batch process. We allocated the majority of resource available to issuing initial calculations to individuals over a period of weeks, and then moved on to the next stage for those individuals who want to progress towards settlement. This ensured that all individuals had an initial calculation to understand their potential liability, which is important for them to be able to make financial decisions.

This approach can mean that some individuals who responded quickly can only move to the next stage once we are ready to do so for the majority of individuals. This is the most efficient way to process such a high volume of settlements, but we recognise some individuals will have experienced delay and waited longer than we would have liked. Broadly, we only include statutory late payment interest up to 30 September 2018 in the contract settlements so no individual is disadvantaged by our delay.

As there are far fewer employer cases, and due to the additional complexity of taking into account National Insurance contributions (NICs) and Corporation Tax, the settlements are each worked from start to finish by one, or a small number, of HMRC staff. This means more employer settlements have been concluded and they will have experienced less delay.

The figures above are not expected to change significantly over the coming weeks as we expect individuals and employers will not progress settling while they wait for the government’s response to the review.

Employer settlements

Settlements between April 2016 and March 2017

Not all settlements that took place after 16 March 2016 until 31 March 2017 were motivated solely or predominately by a desire to avoid the loan charge.

On 16 March 2016, alongside the announcement of what would become the loan charge, the government announced the withdrawal of a significant relief contained in paragraph 59 of Schedule 2 to the Finance Act 2011 (“Paragraph 59”). That announcement prompted many employers to settle their underlying DR liabilities before 31 March 2017, when the relief was withdrawn.

The relief being withdrawn benefited only those employers that had used Employee Benefit Trusts (EBT) that had invested, rather than loaned to employees, some or all of the contributions made to them. Accordingly, such employers cannot be said to have been wholly motivated to settle their disguised remuneration liabilities by a desire to avoid the loan charge. For many, the introduction of the loan charge will not have been relevant in their decision to settle.

Paragraph 59 was introduced alongside Part 7A of ITEPA 2003 to encourage those employers that had used DR schemes before 6 April 2011 to settle with us on the terms of the EBT Settlement Opportunity launched in April 2011 (the “EBTSO” - further detail is provided in the section entitled ‘Settlement Opportunities’).

Paragraph 59 relief applied when income tax was paid on an amount of pre-April 2011 contribution to a DR scheme on the basis that it was earnings. The effect of the relief was that neither that amount, nor any investment returns accruing on that amount, would be taxed under Part 7A ITEPA 2003, when they were subsequently distributed to the employee by, most commonly, the trustee of the EBT.

However, it was announced on 16 March 2016 that the relief - insofar as it applied to investment returns - would only be available where income tax on the pre-April 2011 DR scheme contributions was paid by 31 March 2017. Where tax was not paid by 31 March 2017, Part 7A ITEPA 2003 would apply to the investment returns, whenever they were accrued, when they were eventually distributed to the employee. Please see examples 3 and 4 of the 16 March 2016 Technical Note published alongside the 2016 Budget for more details.

This presented a potentially significant increased tax charge for employers when EBT funds that had been invested, rather than loaned to employees, were eventually distributed to an employee. Therefore, it incentivised such employers to settle with HMRC before 31 March 2017.

Impact of repaying unprotected years on Corporation Tax (CT) liability

Repaying voluntary restitution years on employer settlements has a significant effect on the CT liabilities of the employer.

Some employers did not claim a CT deduction when they use a DR scheme. When employers settled, they usually received a corresponding deduction in their taxable profit for the year of the contribution to the EBT, that in turn reduced their CT liability for that year. If part of these settlements were repaid, HMRC should be able to recover the corresponding CT relief given to employers. If HMRC was not able to do that, the employer would have paid less CT than they should have done for the years in which refunds were being made – and as a result would effectively be receiving a CT windfall for their use of avoidance.

In brief, during the settlement process, HMRC and the employer would usually net off the reduction in CT liability generated by the additional payment of PAYE/NIC (through the settlement).

Table 44 is a very simple example of how this would work, based on a £100 contribution to an EBT (ignoring any allowances).

| Liability to pay PAYE/NIC | £53 |

| Reduction in CT at circa 20% | £10 |

| Associated CT interest credit | £2 |

| Net settlement actually paid by employers | £41 (=53-10-2) |

Furthermore, not all settlements were calculated on the net basis set out above. For example, some employers did not net off the CT relief for the additional PAYE/NIC paid within the settlement but instead claimed the CT relief separately.

In some settlements, the amount of duties payable was reduced because part of the settlement was being accounted for by the EBT trustees. These different bases will have an effect on the calculation of CT relief given and in all cases HMRC should be able to recover the additional CT that is due on the employer’s (now increased) profits.

HMRC should therefore be able to ensure that, irrespective of how the settlement amount was calculated, any repayment of Voluntary Restitution did not lead to the employer obtaining a CT advantage.

The CT relief is normally given in the year of contribution to the EBT. This may have been some time ago. So there will also be associated effects relating to CT rates and interest that HMRC should also be able to take into account.

Go to section 14: Debt collection process.