Send an Earlier Year Update using Basic PAYE Tools

Updated 27 May 2021

From April 2021, if you need to make a correction to an amount submitted in Real Time for a closed year, you will need to use the Full Payment Submission process (FPS). Only use an Earlier Year Update (EYU) for the tax years 2019 to 2020 or before.

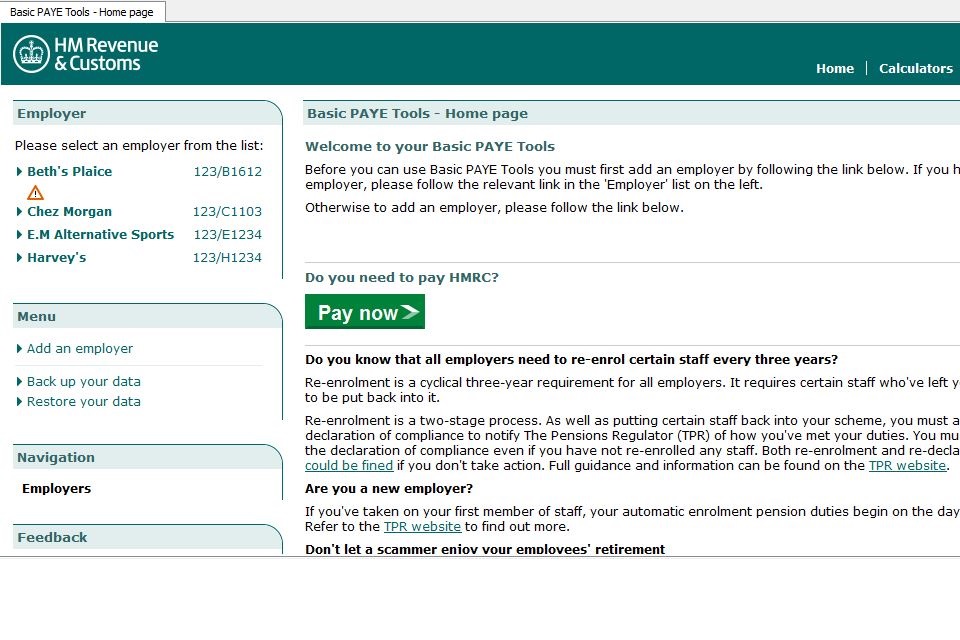

Image showing Basic PAYE tools home screen.

Introduction

This is the Basic Pay as You Earn (PAYE) Tools guide for making an Earlier Year Update (EYU). Use this guide if you currently use the Basic PAYE Tools (BPT) to operate payroll.

The screenshots in this guide are the main ones you’ll need to know about. We have not included all the screens as there are some that most employers will not use because they apply to more unusual circumstances.

Due to continuing improvements the screens in the BPT may look slightly different to those shown within this guide.

Getting started

This guide assumes you’re already using the BPT to run payroll and you’ve already:

- downloaded and installed the software

- set up the employer

- set up your employees

Find out if you can create multiple EYU submissions

We recommend that you complete the full process for each employee separately.

Step 1: select the correct employer

If you’ve added more than one employer to the BPT, you’ll need to select the correct employer.

From the home screen, select the correct employer from the top left of your screen.

In the example, ‘Harveys’ has been selected.

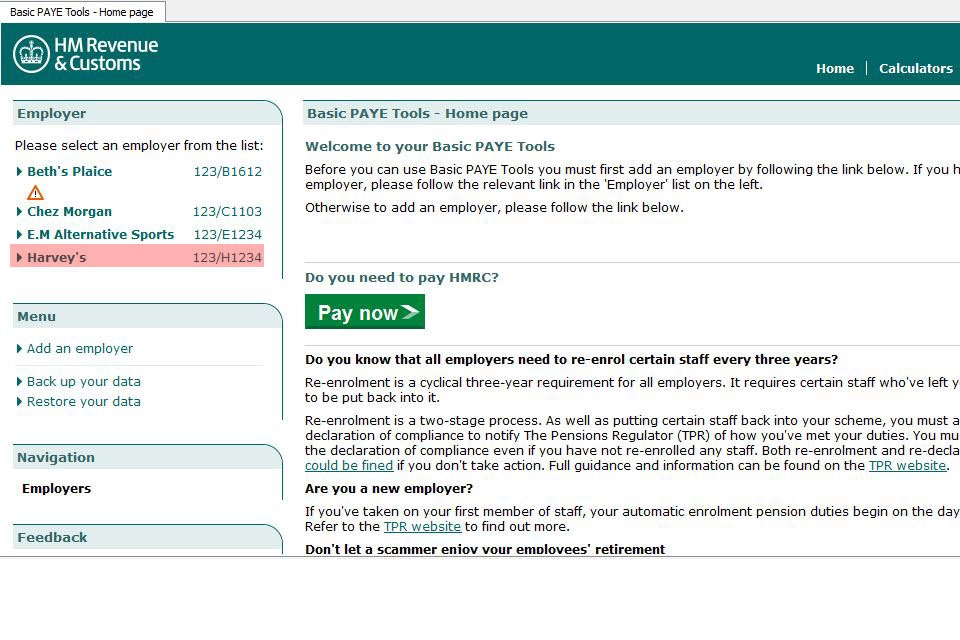

Image showing Basic PAYE tools home screen.

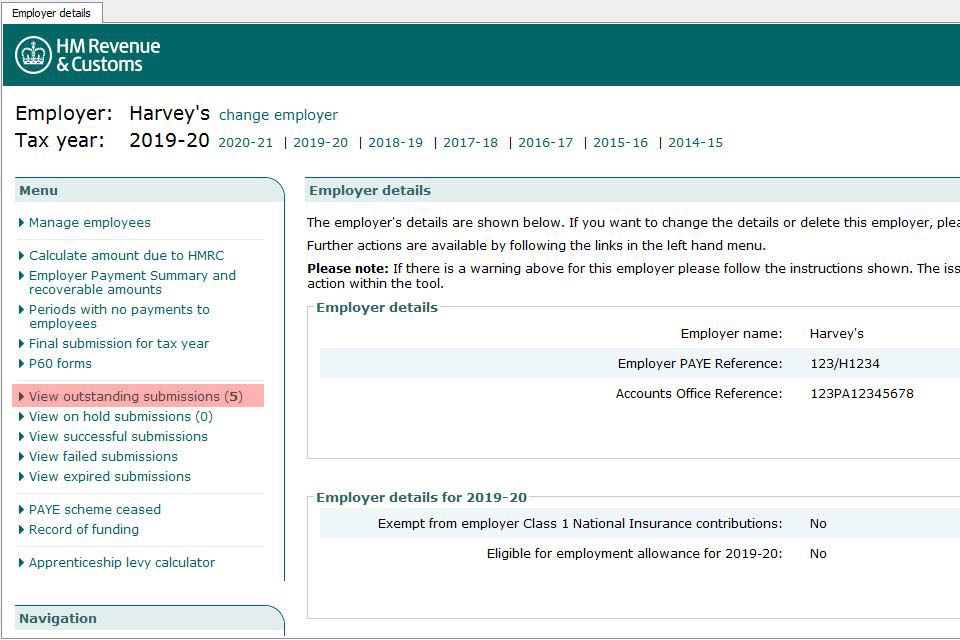

This will take you to the ‘Employer details’ screen as shown.

Check that you have the correct tax year selected, this is shown in the red box in the example.

For example, if you’re creating an EYU for the tax year 2019 to 2020, make sure you select the tax year 2019 to 2020, as shown.

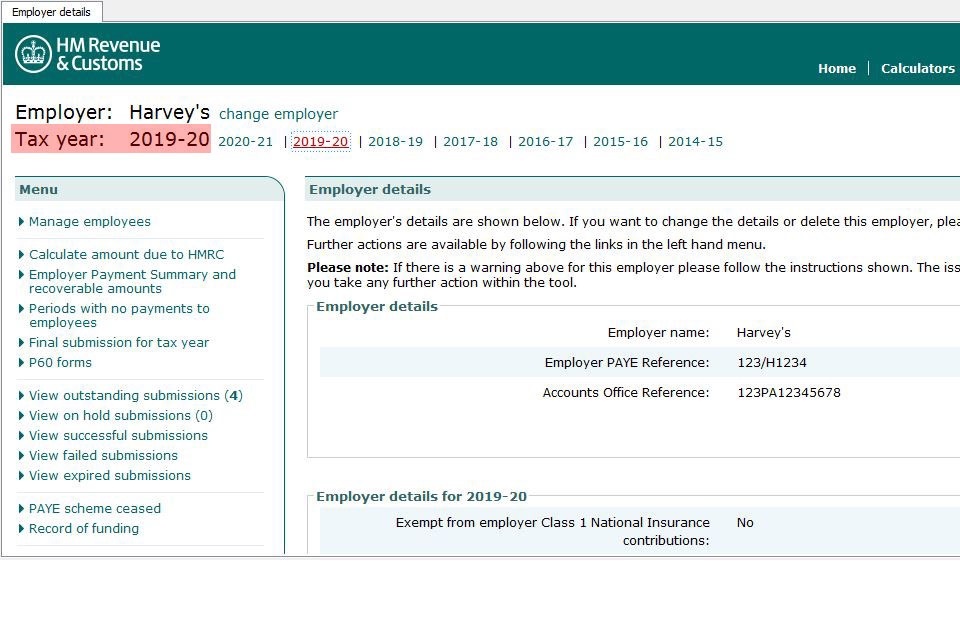

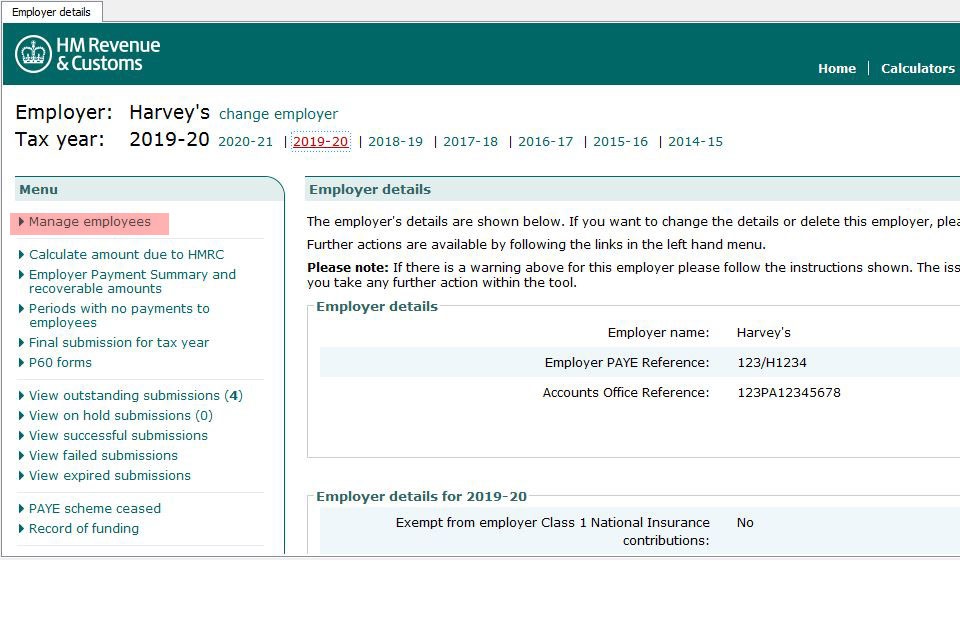

Image showing change employer screen.

Step 2: select the correct employee for the EYU submission

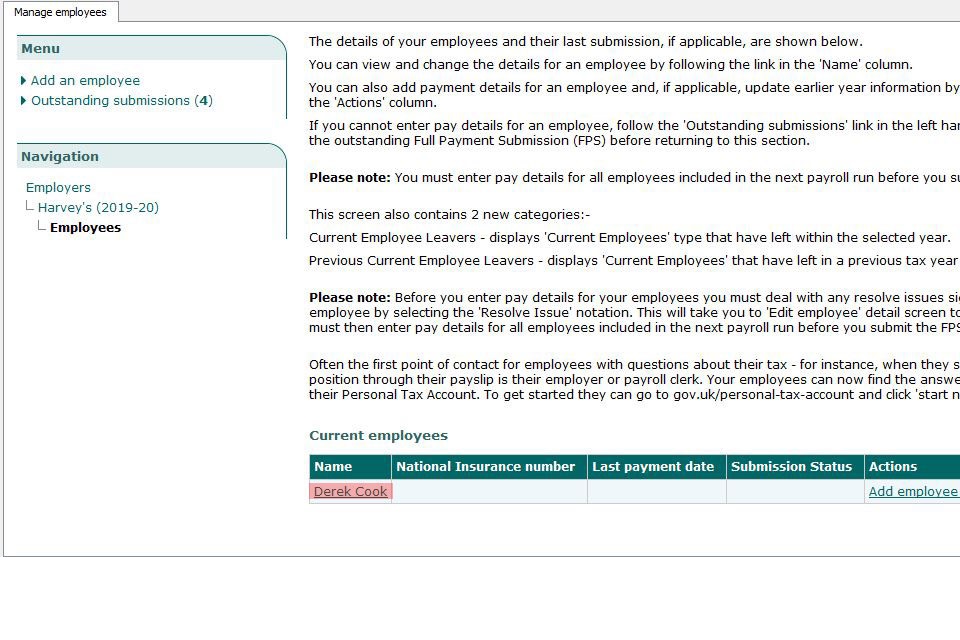

Select the ‘Manage employees’ link from the menu.

Image showing manage employees link.

The next screen shows a list of all ‘current employees’ for the employer.

Select the relevant employee from the list.

Image showing manage employees screen.

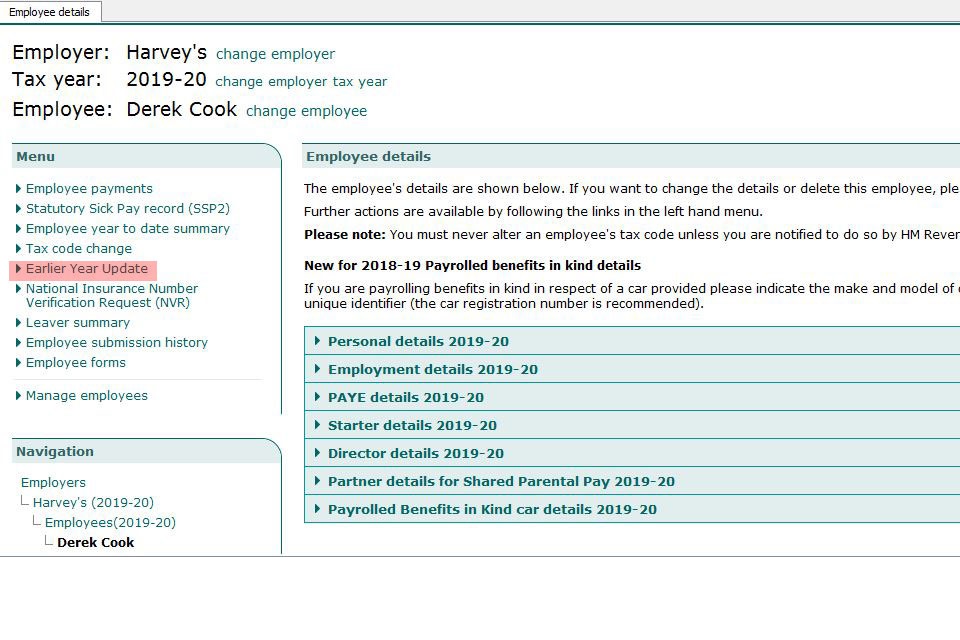

From the ‘Employee details’ screen, select ‘Earlier Year Update’ from the menu.

Image showing earlier year update screen.

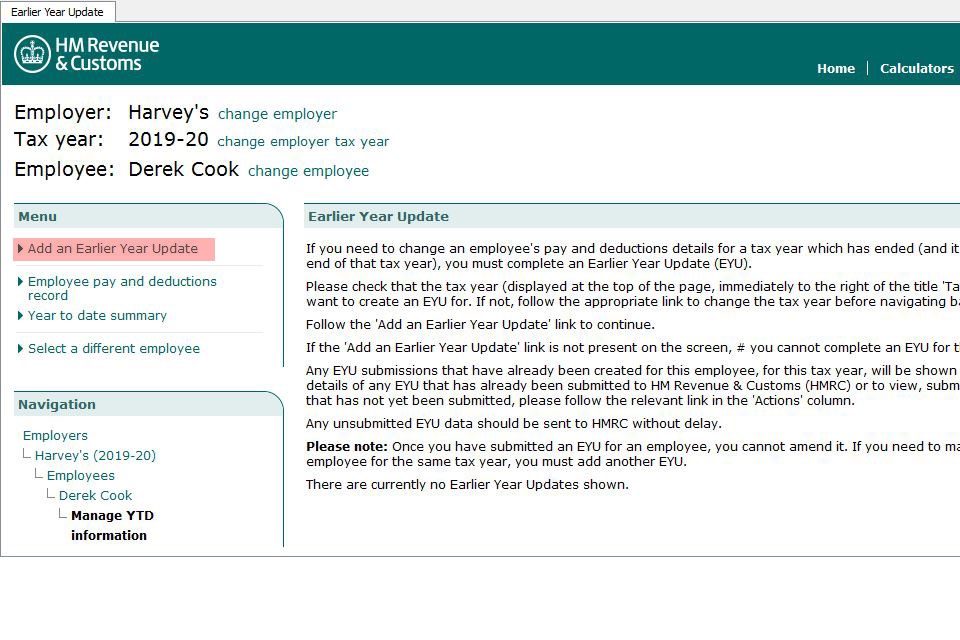

Read the guidance on the next screen and then select ‘Add an Earlier Year Update’ to continue.

Image showing add an earlier year update link.

Enter the correct information

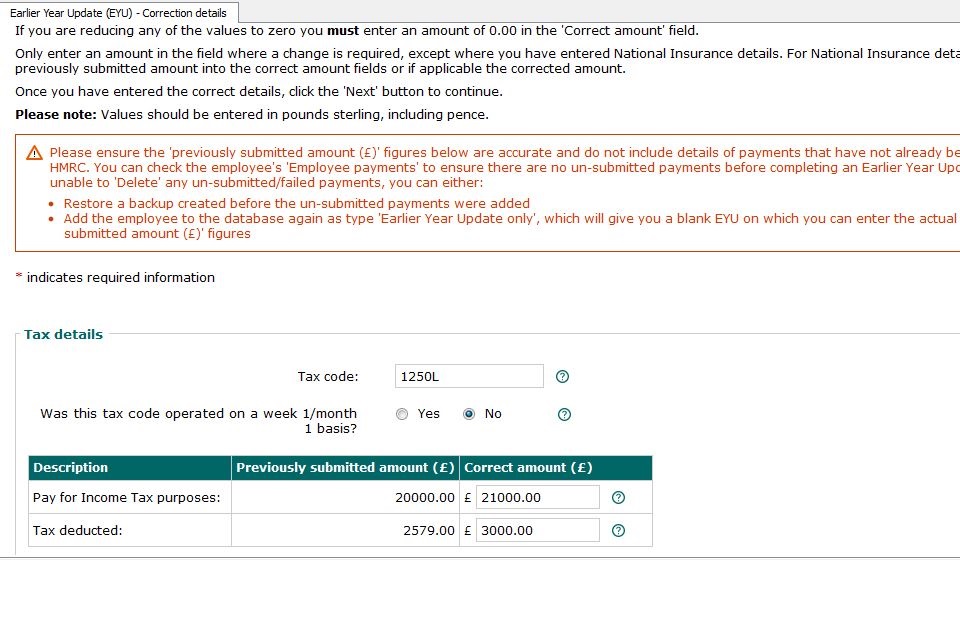

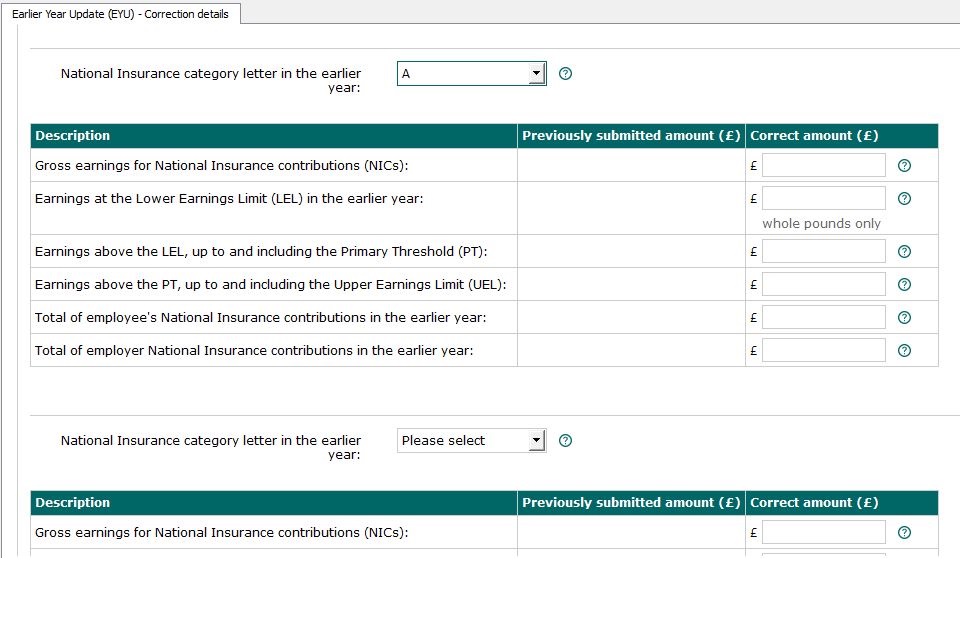

You’ll now see the screen ‘Earlier Year Update (EYU) – Correction details’.

The purpose of this screen is for you to enter the correct amounts where either of the following applies:

- there’s an amount shown in the ‘previously submitted amount’ column

- you have new figures to supply for items that have not been submitted before

You’ll see the amounts in the ‘Previously submitted amount’ column have been imported from the last Full Payment Submission (FPS) for the previous year.

Check that these are as expected.

Read the warning message that is shown on the next screen as this may affect your EYU submission.

If not, check the guidance by selecting the ‘?’ button, if you are still not sure contact the Employer Helpline.

Image showing correction details screen: pay for Income Tax purposes.

Example

If you submitted a year to date figure of pay of £20,000 on your last FPS for the tax year 2019 to 2020 but realised this should have been £21,000, you must enter £21,000 at this stage.

Important

If you did not send the last FPS for the tax year 2019 to 2020 to HMRC then the values in the ‘Previously submitted amount’ column will not represent the latest data sent to HMRC.

If there are any payments created which have never been submitted but should have been sent, view and print the ‘Employee Year to Date Summary’ to provide a record of the correct figure for use when you complete the EYU. Then delete the un-submitted payments before creating the EYU.

If your employee has been allocated a payroll ID, works number or employee number, and you’ve used it when you originally set up your employee, you must enter it here. Failure to do so could result in a duplicate employment record being created for this employee. Otherwise leave this field blank.

Tax code

In the ‘Tax details’ box, enter the tax code and basis of operation correct for that year.

National Insurance category letters

A National Insurance letter is already shown together with the amounts of earnings liable to National Insurance that were previously reported. Enter the correct amounts for that National Insurance letter.

If you need to enter details for a different National Insurance letter, scroll down to the next drop down as shown in the screen print.

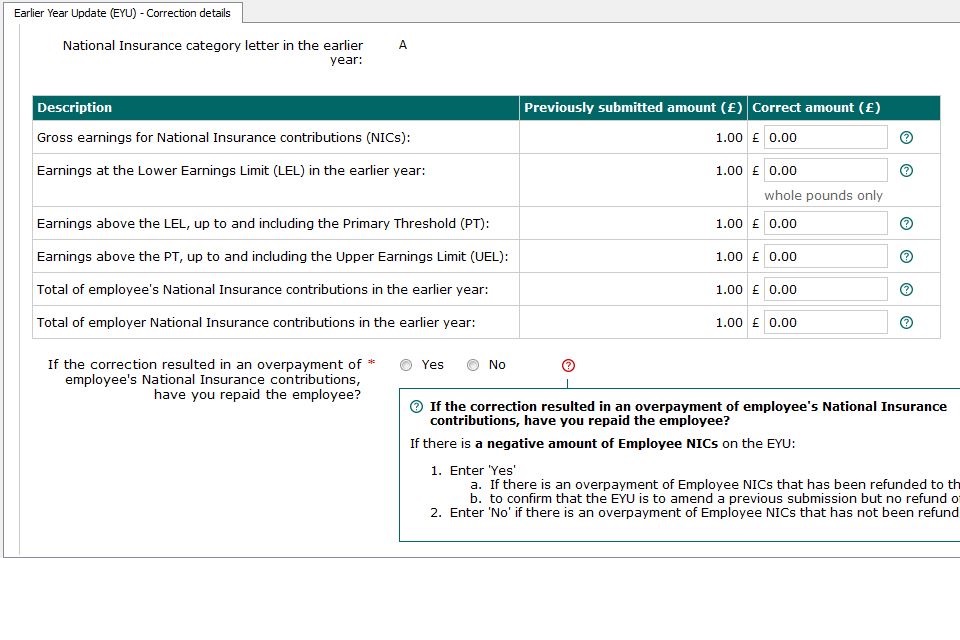

Image showing correction details screen: National Insurance

When completing this screen if there is a negative amount of employee National Insurance contributions on the EYU:

- enter ‘Yes’

- if there is an over payment of employee National Insurance contributions that has been refunded to the employee

- to confirm that EYU is to amend a previous submission but no refund of employee’s National Insurance contributions is due

- enter ‘No’ if there is an over payment of employee National Insurance contributions that has not been refunded to the employee

Image showing correction details screen: National Insurance

Statutory payments and student loans

Enter details of any of the following that need amending:

- statutory payments

- student loan deductions

- post graduate loan deductions

When you’ve completed all relevant boxes on this screen, select ‘next’ to continue.

Important

You must enter the full amounts in the ‘Correct amount’ column, not the difference between the previously submitted figure and the correct figure.

Select ‘next’ to move to the next screen.

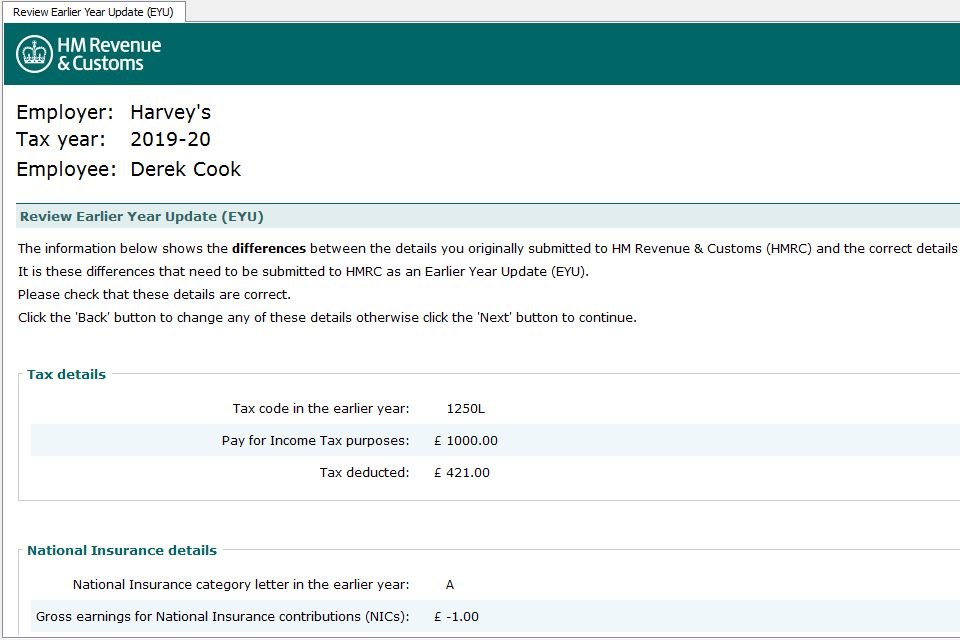

Review EYU

The next screen will show the differences between the amounts you previously submitted to HMRC and the correct amounts.

The ‘differences’ are the figures that will be sent to HMRC on the EYU.

Image showing review earlier year update screen.

Make sure you fully review this screen and check the differences between the previous and corrected figures are what you expect.

This data will form the submission that is sent to HMRC.

Select ‘next’ to move to the next screen.

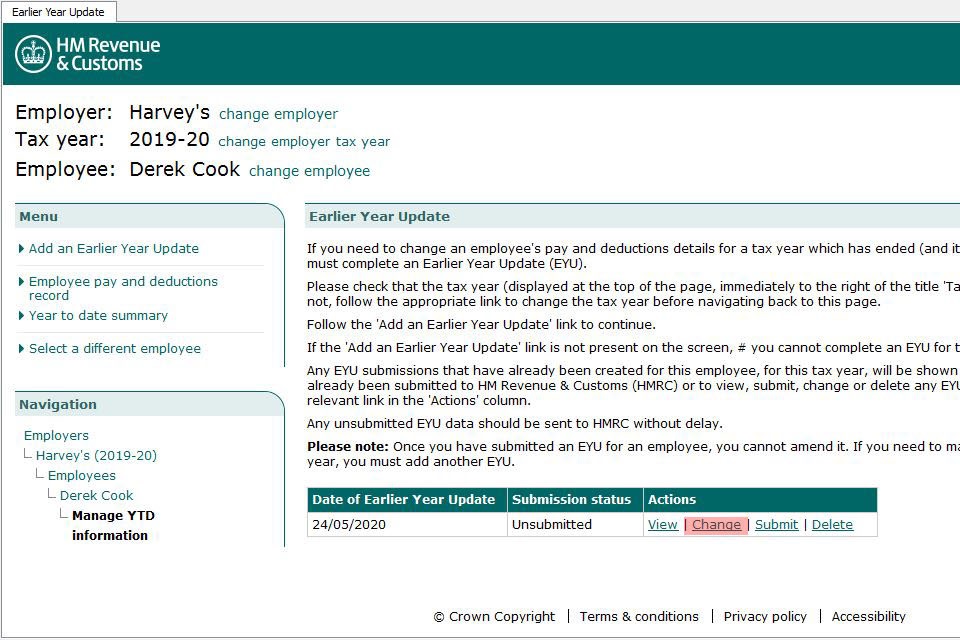

Find out if you’ve made a mistake

If you have not yet submitted the EYU you can do either of the following:

- change the ‘correct amount’ details

- delete the EYU and start again

To do this, select the relevant employee from the menu, then select ‘Earlier Year Update’ from the menu.

Image showing change earlier year update link.

Important

Once you have submitted an EYU for an employee, you cannot amend it. If you need to make further changes for this employee for the same tax year, you must create another EYU.

Step 3: send the EYU

You have now created the EYU ready to be sent to HMRC.

You can create an EYU for other employees by repeating Step 2 above, but you may prefer to send the one you have created before starting with another employee.

When you’ve finished creating the EYU you must send the submissions to HMRC.

Select the correct employer from employer list on the ‘home screen’.

This will take you to the ‘Employer details’ screen.

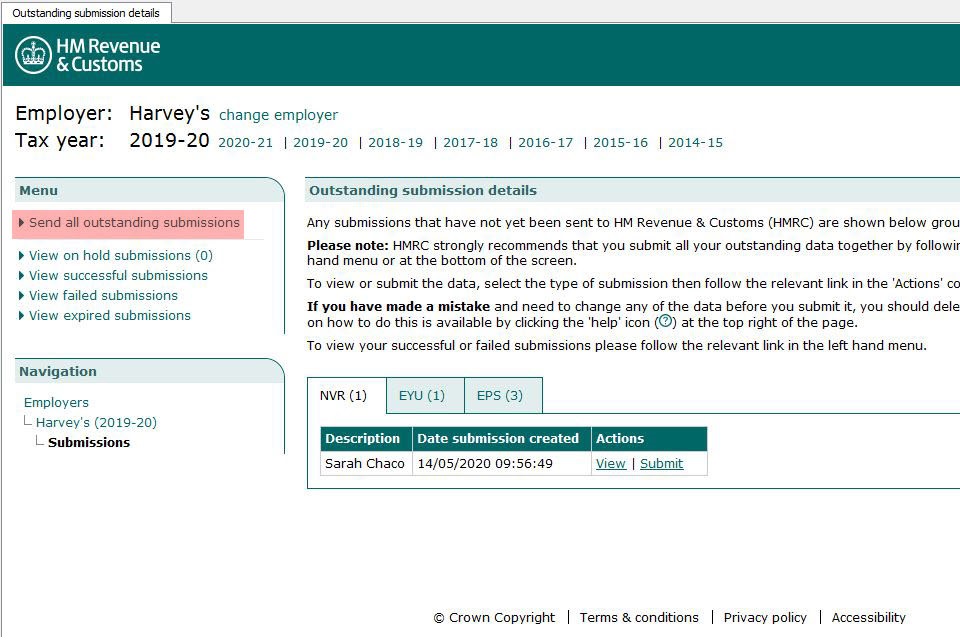

Image showing employer details screen.

Here you can see there is one outstanding submission which is the EYU for Lee Morgan.

Select ‘send all outstanding submissions’.

Image showing outstanding submission details screen.

Read the information on the next screen then select ‘next’. Select the ‘view outstanding submission’ link from the menu.

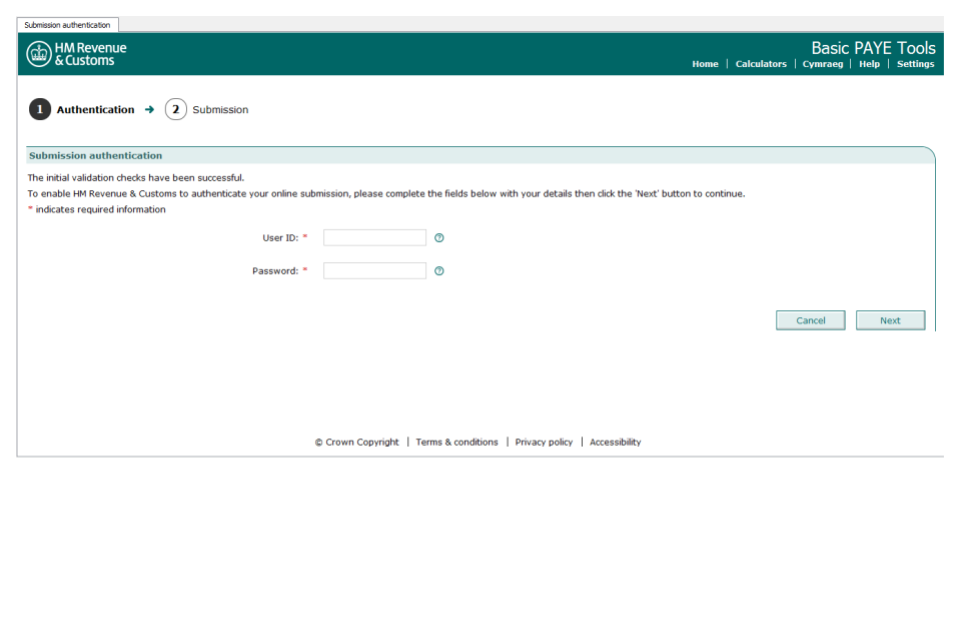

Enter your Government Gateway ‘User ID’ and ‘password’ in the blank boxes for online submission, and then select ‘next’.

Image showing BPT submission authentication screen.

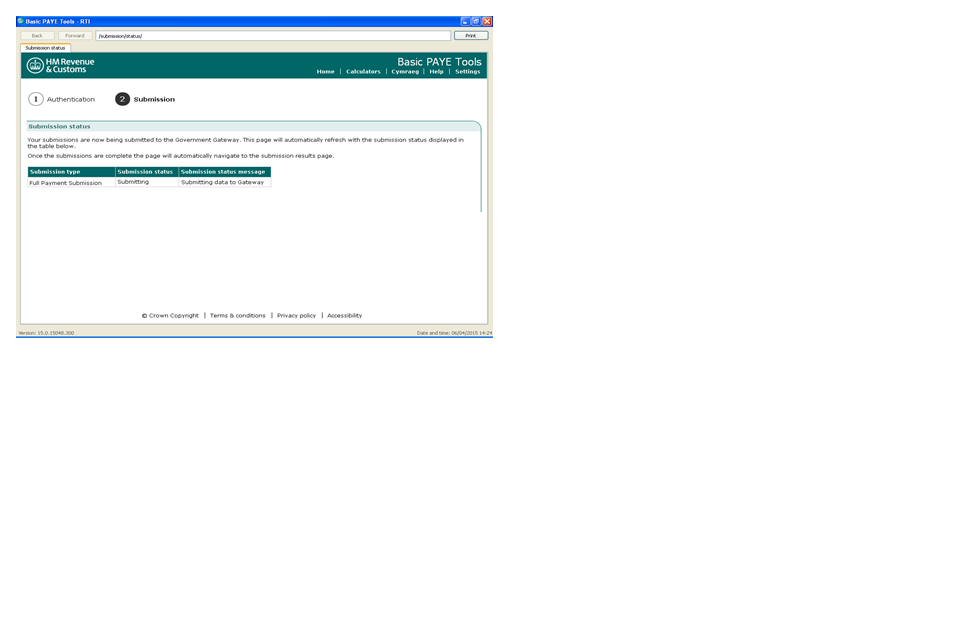

You should then receive the following success message.

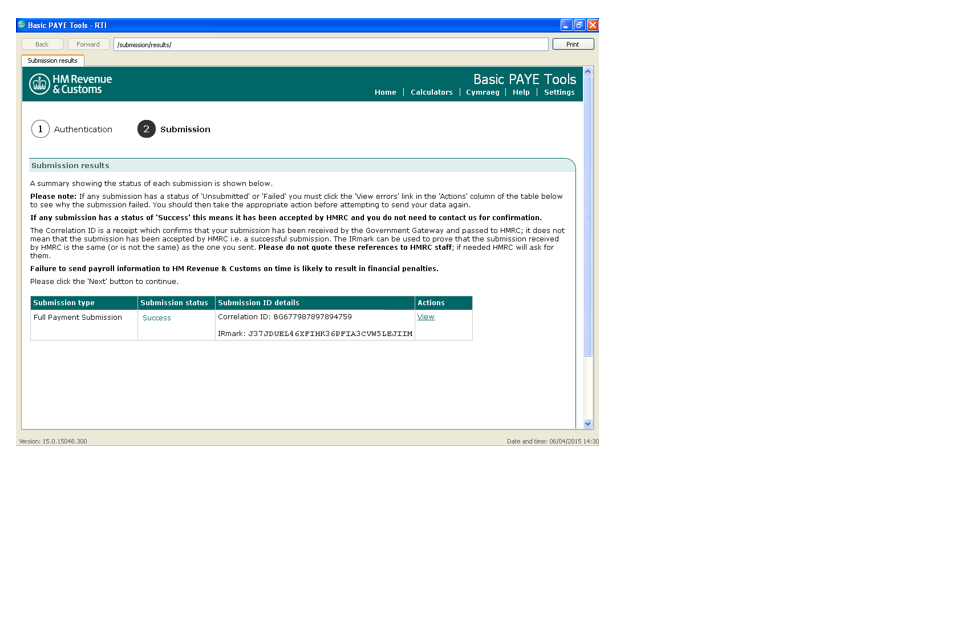

Image showing BPT submission status screen.

Finally you will receive a screen showing your submission results including a unique reference number for your submission.

Image showing submission results screen.

Important

Print any EYU submissions and keep with your payroll records, as a prompt if there are any further queries on this employee’s record.

Step 4: Basic PAYE Tools error codes

HMRC is aware that some BPT users have received error messages when trying to submit an EYU. These messages mean that your submission has not been successfully received by HMRC. The following table gives the error message you may see as well as a description of what you have to do to correct the submission.

| Error message | What you need to do |

|---|---|

| Accounts Office reference or Employer PAYE reference is incorrect | The Employer reference and/or Accounts Office reference is incorrect. Check both of them against paperwork from HMRC and amend the incorrect one. For help in doing this refer to All users: using Basic PAYE Tools for real time reporting and work through the ‘Finding your way round the Basic PAYE Tools’ and ‘Employer overview’ sections until you select ‘Change employer details’. |

| This submission cannot be accepted as the pre-defined date for the previous tax year has not yet passed | If you were trying to send an EYU for the tax year 2017 to 2018, you cannot send an EYU for the tax year 2017 to 2018 until 20 April 2018. Wait until 20 April 2018 then send the EYU. |

| This submission cannot be accepted as it does not fall within the eligible filing period | If you were trying to send an EYU for the tax year 2012 to 2013, you cannot submit any Real Time Information (RTI) submissions for the tax year 2012 to 2013 unless you were one of the small number of employers who took part in the RTI pilot during the tax years 2012 to 2013 or 2013 to 2014. You must send amended forms P35 and P14. You cannot do this using BPT. The software that you used to run your payroll in the tax year 2012 to 2013 may allow you to do this, otherwise you can use the online forms which are part of HMRC’s PAYE Online service. |

| - Error code: 7900 - The [ECON] is mandatory if any [NILETTER] is one of ‘D’, ‘E’, ‘I’, ‘K’, ‘L’, ‘N’, ‘O’ - [ECON] is mandatory if any [NILETTER] is one of ‘D’, ‘E’, ‘I’, ‘K’, ‘L’, ‘N’, ‘O’ - Diagnostic Message: Assertion failure: |

This EYU cannot be sent to HMRC as the employee has a contracted-out NIC letter (D, E, I, K, L, N or O) but you have not provided the Employer Contracted-Out Number (ECON). Background: - an ECON is a reference number allocated to an employer who operates, or is part of a group of companies that operate, a contracted-out pension scheme for their employees - an employee can only be on a contracted-out NIC letter (D, E, L, I, K, N or O) if you the employer have a contracted out pension scheme that the employee is a member of - if you have a contracted-out pension scheme then you will have an ECON Action required: You need to either: - Add the ECON to the Employer details. For help in doing this, |

| refer to All users: using Basic PAYE Tools for real time reporting and work through the ‘Finding your way round the Basic PAYE Tools’ and ‘Employer overview’ sections until you select ‘Change employer details’. The ECON is shown on the contracting-out certificate issued by HMRC previously issued by Inland Revenue or Department of Social Security when an employer elects to be contracted- out. If you are unable to find your ECON contact the HMRC Contracted-out pensions helpline. OR If you do not have an ECON you will need to telephone HMRC’s Employer Helpline on telephone: 0300 200 3200 and advise them you are receiving error code 7900 and that you do not have an ECON. |